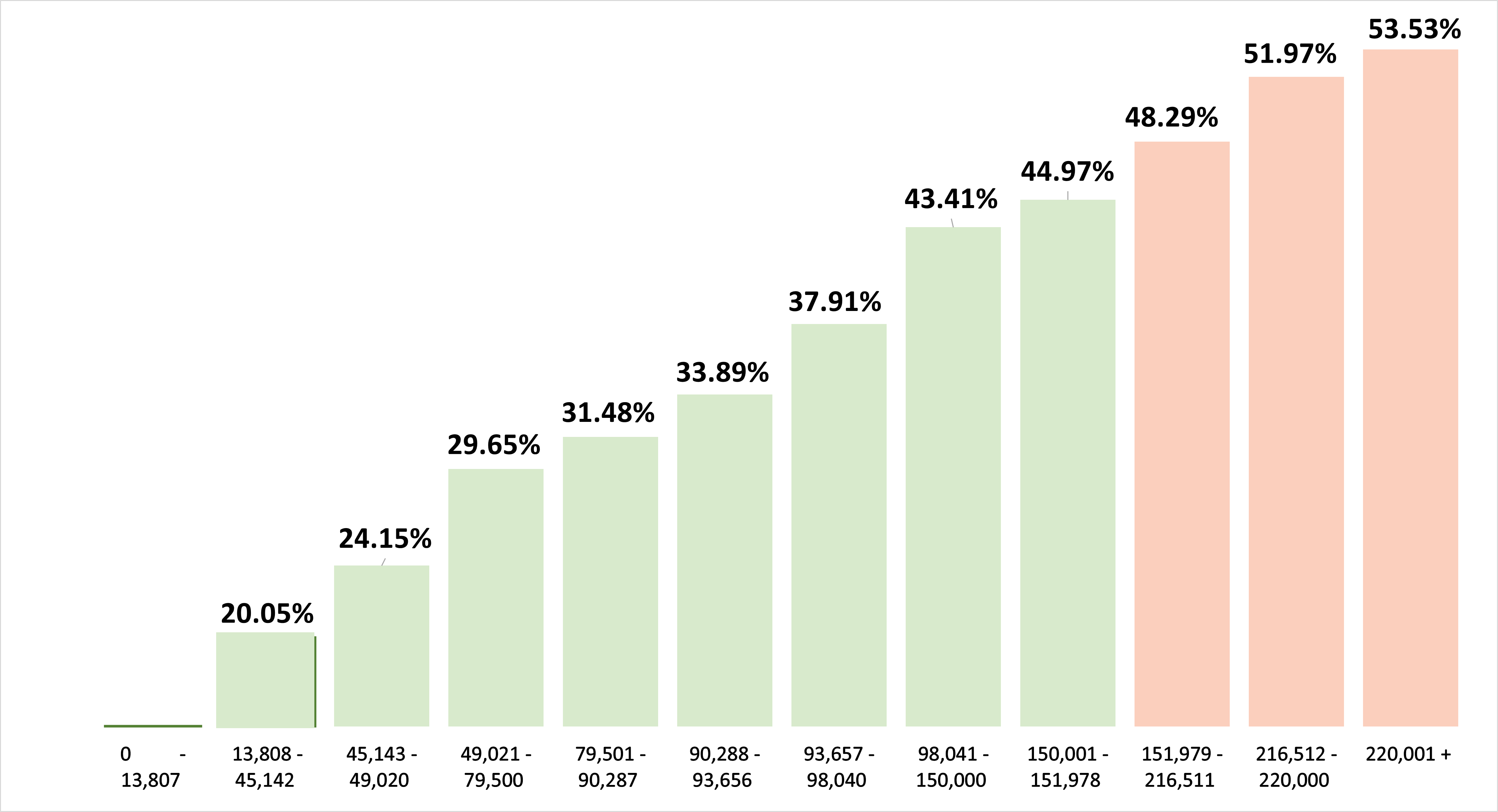

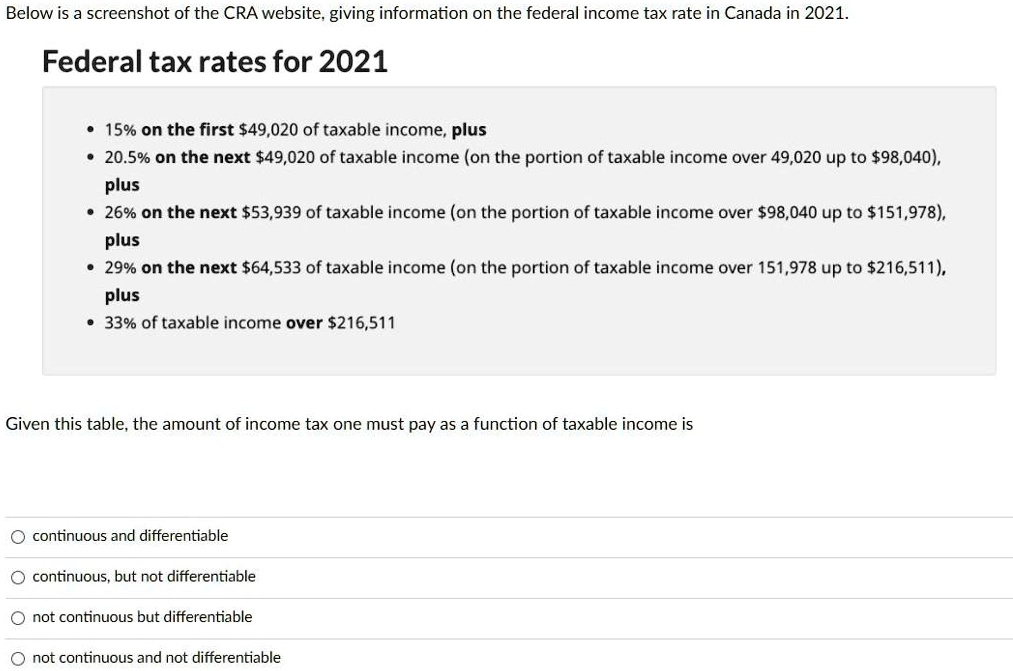

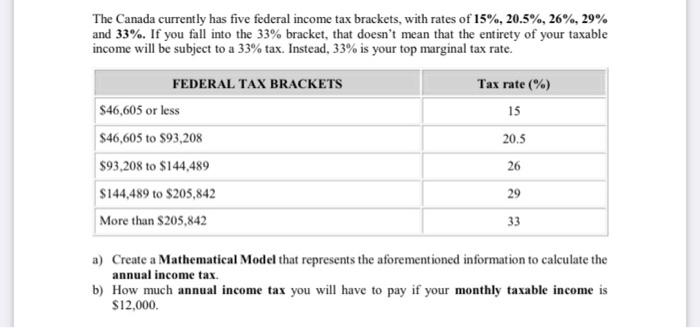

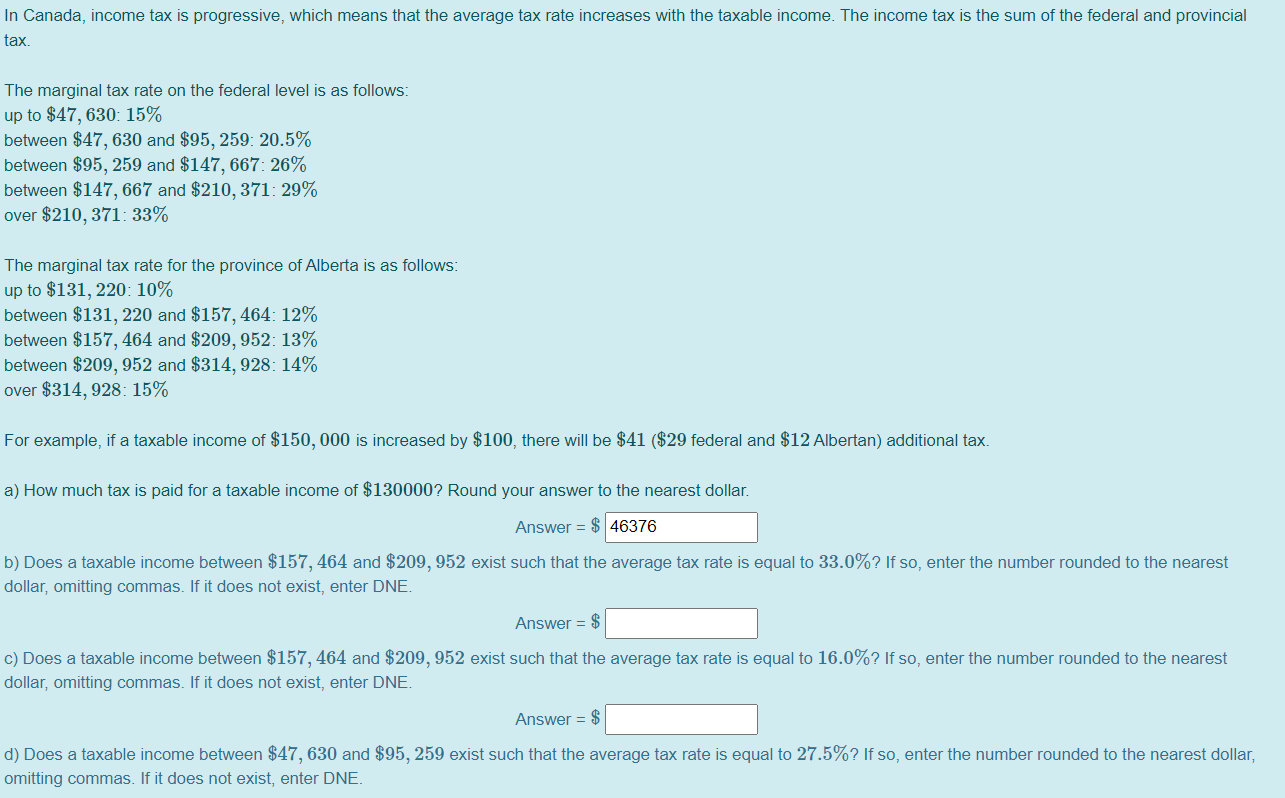

SOLVED: Below is a screenshot of the CRA website: giving information on the federal income tax rate in Canada in 2021 Federal tax rates for 2021 15% on the first 549,020 of

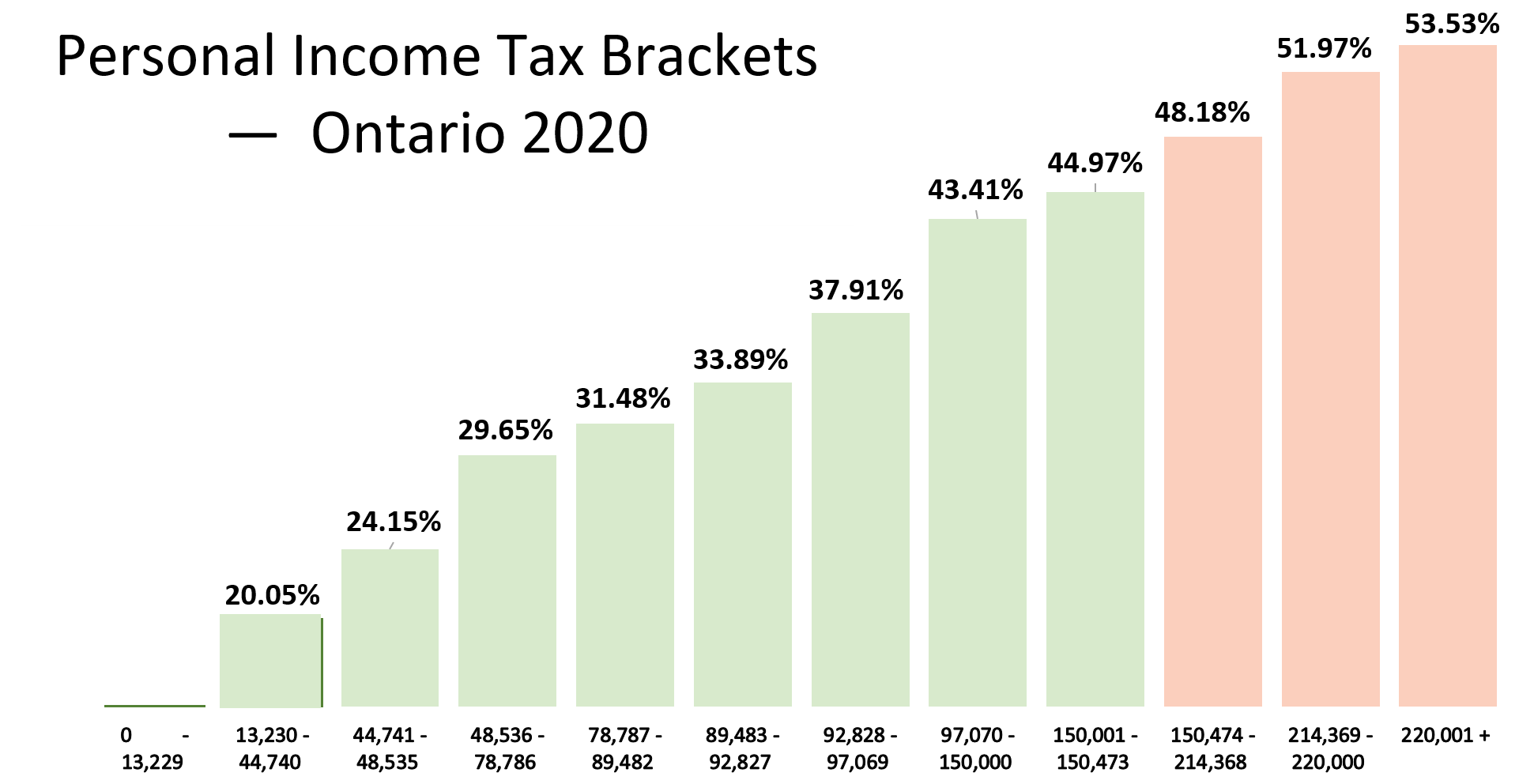

2022 tax rates, brackets, credits | combined federal/provincial tax brackets | Manulife Investment Management

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)